News of the Week (February 27 - March 3)

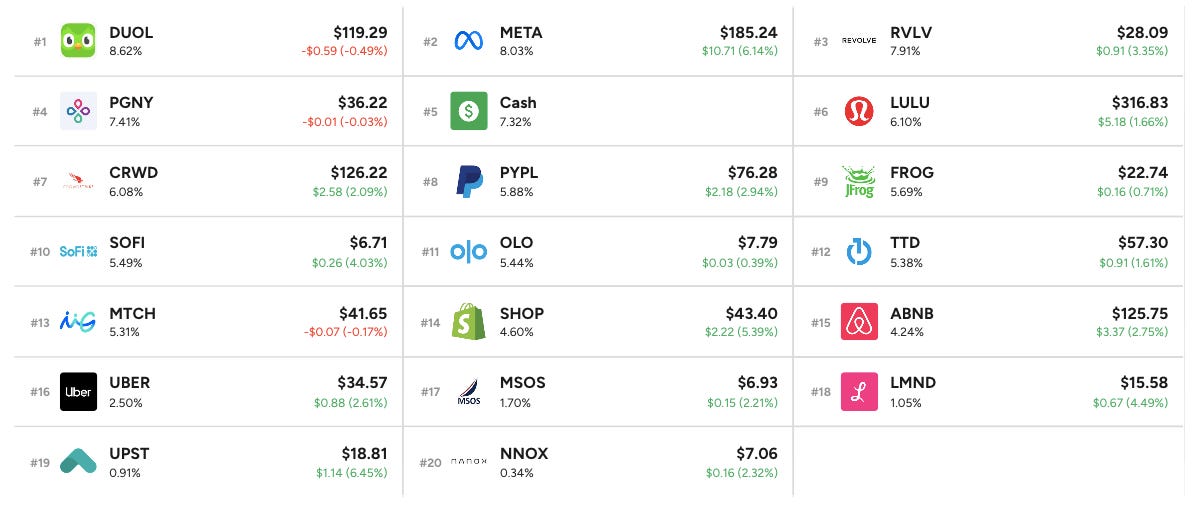

Duolingo; Progyny; SoFi; PayPal; CrowdStrike; Meta Platforms; Upstart; Cresco Labs; Snowflake; Salesforce; Zscaler; Hims; Visa; Macro; My Activity

Welcome to the 229 new readers who joined us this week. We’re delighted to have you as subscribers & determined to provide as much value & objectivity as possible.

1. Duolingo (DUOL) -- Q4 2022 Earnings Review

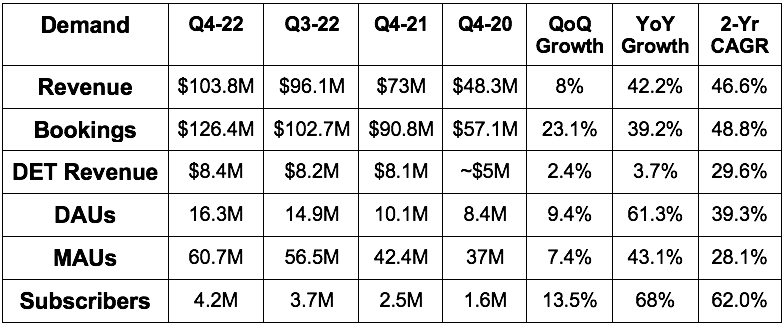

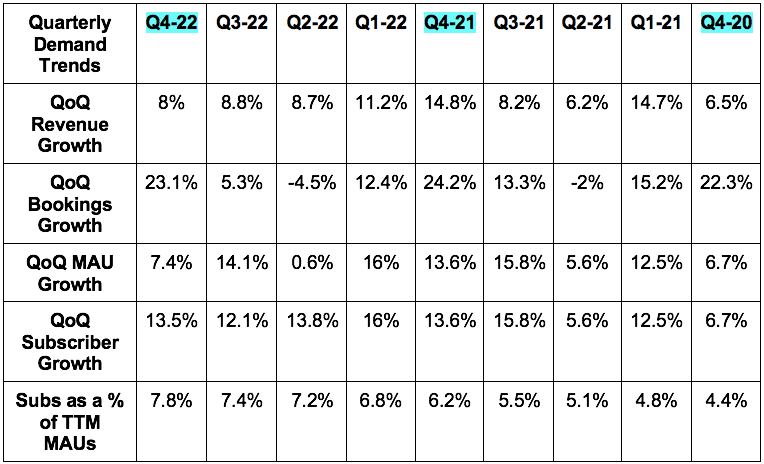

a) Demand

Beat revenue estimates by 3.9% and beat its guidance by 4.3%.

Beat its bookings guidance by 11.4%. This is a great indicator for forward revenue growth.

More Demand Context:

Revenue grew 47% YoY in 2022 vs. the 2021 pandemic pull forward period while bookings 48% YoY. It accelerated user growth for the 6th straight quarter. 90% of this growth continues to be from organic word of mouth as it prioritizes product improvement over advertising to win user attention -- which clearly continues to work. There is no slowdown in view for this digital app unlike pretty much every other digital app post-pandemic. Comps got more & more difficult, yet it continued its acceleration. This is in direct contrast to macro trends, expectations, and peers. Wildly impressive to me. And as readers know, I only talk like this if the results are truly excellent. If they were bad, I’d tell you like I always do.

Growth was entirely driven by paid subscribers. Advertising revenue was flat YoY amid a tough demand environment while subscription revenue rose 53% YoY and was unaffected by poor macro.

Duolingo English Test (DET) growth is very lumpy.

Foreign exchange (FX) diminished YoY bookings growth by 700 bps and revenue growth by 500 bps. FX impact hits bookings over a full year period vs. monthly for revenue. This is due to the annual subscription nature of this company’s business model.

In-app purchase (IAP) grew 100%+ YoY.

Annual subscribers and annual family plan subscribers reached 91% of total subscriptions vs. 85% QoQ. This makes its revenue growth ideally visible.

3 million DAUs have a 365+ day streak. It took it 8 years to get to 1 million and less than 2 years to get from 1 million to 3 million.

Newer users are converting to paid at a higher clip than previous cohorts.

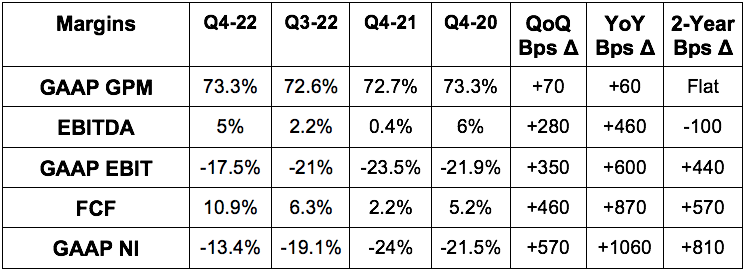

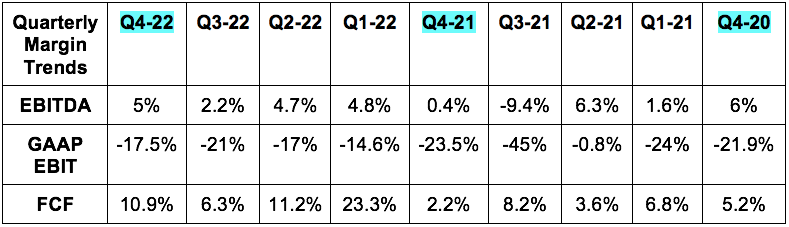

b) Profitability

Duolingo was expected to lose $1.3 million in EBITDA while it guided to losing $1.3 million in EBITDA. It generated positive $5.2 million in EBITDA, sharply beating expectations.

Beat -$0.53 GAAP EPS estimates by $0.18.

Beat GAAP gross profit margin (GPM) estimates by 60 basis points (bps).

More Margin Context:

It’s trying to operate at $0 in EBITDA, investing aggressively in product, yet it still generated positive EBITDA.

Interest income is why GAAP Net Income was greater than GAAP EBIT.

2022 EBITDA of $15.5 million for a 4.2% margin compares to -$1.1 million last year and a -0.4% margin. This rapid margin expansion is set to accelerate further in 2023.

GPM improvement was credited to stronger subscription retention and lower Google App Store fees.

IPO related stock compensation continues to hit GAAP margins for now. This impact will continue to diminish over time. EBITDA offers a good sense of how profitable this company would be without these transitory non-cash expenses.

c) Forward Guidance

Q1 2023:

Beat revenue estimates by 6%.

Beat EBITDA estimates by 78%.

2023:

Beat revenue estimates by 7.1%.

Beat $23.6 million EBITDA estimates by 130%. That is not a typo. The EBITDA guide implies an 11% 2023 margin vs. 4.2% in 2022 and a 30% incremental EBITDA margin which -- for the first time ever -- matches Duolingo’s long term EBITDA margin target of 30-35%. Business is boomin’.

Duolingo’s implied 2023 EBITDA multiple shrank from over 140x to 70x with this massive beat. Still expensive, but so much more reasonable considering EBITDA will triple YoY in 2023. I also think these estimates will continue to rise as Duolingo has established a strong track record of under-promise, over-deliver since going public.

It will hire less people in 2023 than 2022 but will continue to hire with no layoffs. Duolingo’s revenue growth rate has doubled its headcount growth over the last 4 years.

Operating leverage across all cost lines for 2023 is expected.

“Our user diversification results in a business largely uncorrelated with macro and geographic trends.” -- Co-Founder/CEO Luis von Ahn

d) Balance Sheet

Duolingo has about 18% in total stock dilution that will take effect over the next 10 years.

It expects 2023 diluted share count to grow 2% YoY vs. 3% growth in 2022 as IPO-related equity awards slow.

Stock comp was 20.3% of sales vs. 22.4% YoY. Please note that this includes founder awards that will not vest until Duolingo eclipses share price targets. The next target is $178.50 per share.

$608 million in cash & equivalents.

No debt

I wouldn’t mind a small buyback to offset comp-related dilution like we’ve seen with other growth stocks like Olo and The Trade Desk. It generates cash and has a large enough cash position to comfortably continue growing operating expense buckets while allocating funds to repurchases. A buyback would not preclude investments in product perfection & expansion.

e) Letter & Call Highlights

Duolingo’s Unique Flywheel:

More data = more split testing (A/B testing) = better products = more word-of-mouth growth.

Unlike competitors which conversely lean on…

More ad dollars = more external customer acquisition = more growth.

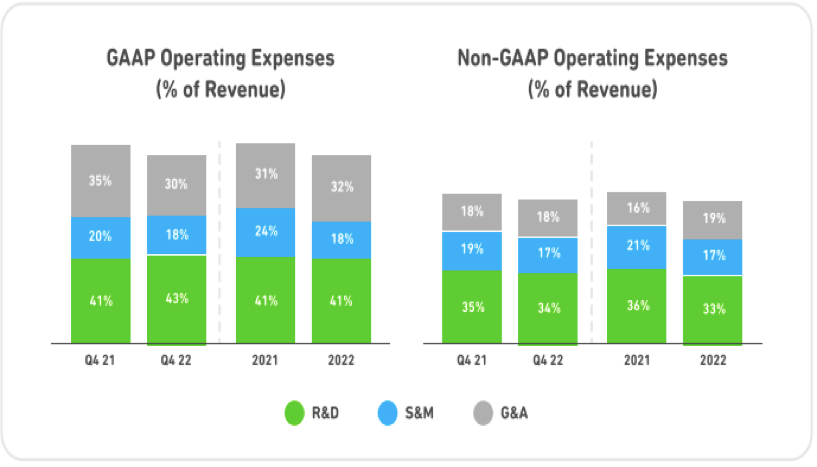

This is why Duolingo’s 2022 revenue growth rate was more than double its sales & marketing growth rate. This continues to pave the way for more operating leverage as can be visualized in the image below:

2023 Priorities:

Generative AI (mentioned 9 times in the call) was a key theme of the shareholder letter and transcript. Duolingo isn’t embarking on this journey alone, but through a tight partnership with OpenAI (AKA ChatGPT parent) where the two crafted generative AI models purpose-built for language learning. Duolingo brings the largest language learning data set in the world to the table to rapidly season models built by OpenAI and Duolingo in tandem.

Duolingo has always invested heavily in AI algorithms like its Bird Brain model (which designs individual course difficulty based on historical user data). Now, it’s ready to extend those investments to the world of generative AI as it thinks “technology has advanced to a level of our vision to teach nearly as well as a human tutor.” Generative AI benefits in the short term are expected to include more engaging content as well as cheaper, more expedient content creation.

As part of this newer focus, Duolingo will launch a new, more expensive subscription tier -- called Duolingo Max -- to markets this year. New tools from this tier include “Explain my Answer” for AI-powered explanations talking through learning blunders. The other tool called “Roleplay” lets users talk with Duolingo characters to emulate conversational skill building.

Beyond this, the generative AI investments are expected to improve Duolingo’s ability to teach English to more advanced speakers. It sees the dichotomy of 90% of global language students learning English, yet just 45% of Duolingo users doing so as a growth vector to address.

New Products:

It expects $0 in bookings from the new Duolingo Max subscription. I am confident that this contributes materially to 2023 bookings and allows them to raise guidance throughout the year.

Duolingo expects $0 in bookings contribution from the new Math and ABC apps. It takes its time on monetization to ensure product market fit before charging and this will not be a source of guidance upside.

Final Notes:

Current user retention rate (probability of a DAU coming back) is now 80% vs. 65% at the IPO.

Duolingo’s subscription price changes in international markets (to lower costs in line with GDP per capita) are largely complete. Interestingly, outperforming conversion is leading management to think it can re-hike some of the prices in these markets in 2023.

China’s online degree ban has had no impact on Duolingo English Test (DET) revenue.

While travel is a use case for Duolingo learners, it is a minor use case. The travel acceleration we’ve seen from vendors throughout the quarter and into 2023 is not the source of this outperformance. It is more structural in nature than that.

50% of revenue continues to be non-dollar denominated. For every 100 bps in currency exchange fluctuation, Duolingo will earn $2 million more or less in revenue.

f) My Take

As I said on Twitter, this was the best quarterly report and guide I’ve covered this season. There’s nothing negative to pick at, only positives to celebrate as a shareholder. Two thumbs up from me -- and if I had a third it would be pointed up as well.

I have no plans to trim despite the large spike in the stock. Rapidly rising profit estimates mean that appreciation in share price is entirely earned in my view.

2. Progyny (PGNY) -- Q4 2022 Earnings Review

a) Demand

Mid-period, Progyny revised its fourth quarter revenue guidance higher from $207.4 million to roughly $212.4 million. It beat this raised bar by 1.0% and beat analyst estimates (which rose in conjunction with the announcement) by 1.2%. It beat its original guide by 3.3%.

More Context on Demand:

7th straight year of near 100% gross client retention. Once an employer adds a benefit, they’re “extremely reluctant” to take that coverage away from their employees.

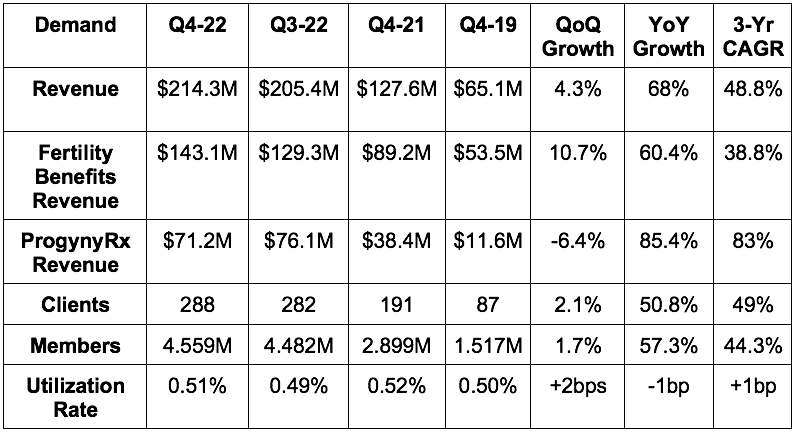

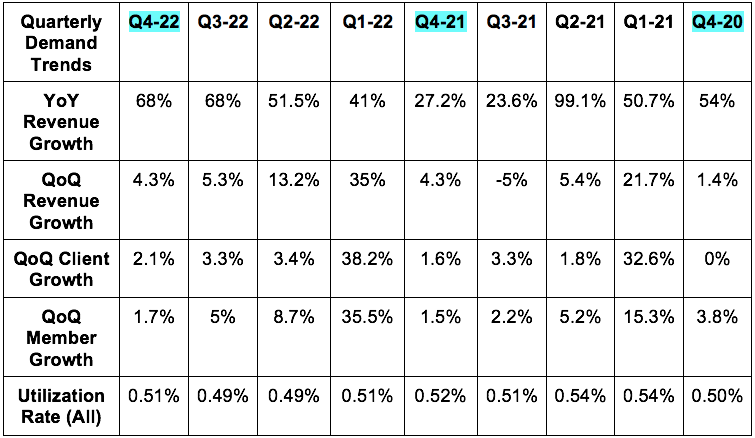

Progyny’s 48.8% 3-year revenue CAGR compares to 49.7% last Q & 51.4% 2 Qs ago.

As we can see above, the fourth quarter is not a large contributor to annual growth for this healthcare service provider. Typically, most clients won during the year go live in the following year’s first quarter.

Utilization rates remain largely stable despite erroneous short seller claims. This is despite outperforming new client growth and utilization rates for new clients beginning at a trough.

New fertility treatment courses were briefly halted at the beginning of the pandemic in Q2 2020. That led to easy comps and is why Q2 2021 revenue grew by 99.1% YoY. Resurfacing variants again weighed on growth in late 2021 which makes this quarter’s YoY comp somewhat easy. Growth will slow to the 30-35% range going forward. Fine with me.

b) Profitability

Beat EBITDA estimates and its identical guide by 3.1%.

Beat $0.01 GAAP earnings per share (EPS) estimates and its identical guide by $0.02.

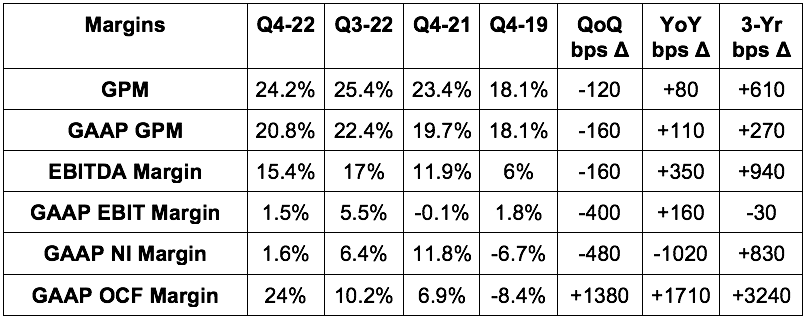

It guided to operating cash flow (OCF) of $50 million mid-quarter when it raised its revenue guidance. This was stronger than expected by a wide margin. And it beat this strong update by another 3%. It is clearly having no issues with collections as EBITDA to OCF conversion continues to skyrocket from 38.6% to 64% YoY. And that’s not surprising considering its collections come from some of the richest companies in the world. Yet another short seller claim divorced from reality.

More Margin Context:

Net income fell 78% YoY. That seems concerning on the surface, but it isn’t. This was solely related to a $733,000 tax expense this quarter vs. a $15.5 million tax benefit YoY. With this same benefit in Q4, 2022, net income would have been $19.6 million for 30% YoY growth. This is why adjusted EBITDA -- which doesn’t include this impact -- more than doubled YoY to $33 million.

The difference between GAAP GPM and GPM is due to an equity package issued in Q4 2021. This will vest throughout 2023 when these margins will again converge. You’ll notice they were identical pre-package in Q4 2019.

This same package hit GAAP income statement margins this quarter, last quarter and Q4 2021 as well. This amplified the YoY net income impact discussed in the first bullet.

This package is the source of most GAAP cost buckets rising in 2022 vs. 2021. This is temporary and GAAP EBIT margin rose regardless thanks to excellent demand performance.

YoY OCF comps are a bit weird due to recently re-negotiated pharmacy contracts as Progyny gains more scale and bargaining power. This raises its overall cash flow collection from the segment and changes the timing of these collections. That aided the wild margin expansion we saw here YoY. Still a strong result, but this needs to be noted.

2022 EBITDA margin was 16.0% vs. 13.5% YoY. Its 2022 incremental EBITDA margin was 20.4% which points to another 440 basis points of future operating leverage as contracts renew.

c) Forward Guidance

Reiterated the anticipation of eclipsing 370 clients in 2023 and 5.4 million covered lives. It continues to assume 0 contribution from existing client organic employee growth as tech layoffs continue. Fortunately, most of the other sectors represented in its client base continue to hire with unemployment near generational lows.

Met revenue estimates.

Beat EBITDA estimates by 1.5%.

Missed $0.33 GAAP EPS estimates by $0.04. This, as always, excludes income tax benefits including benefits via stock comp which should continue in 2023.

Expects a 19.4% incremental EBITDA margin to power more margin expansion.

Early client launches in 2022 to lead to slower second half growth vs. first half growth.

d) Balance Sheet

Stock comp was 13.7% of sales vs. 11.3% QoQ & 11.8% YoY. This rise is due to more of the aforementioned equity package vesting.

$274 million in cash & equivalents.

$0 debt.

e) Call & Release Highlights

On Client Diversification More than Offsetting The Growth Headwind from Tech Sector Layoffs:

“We now have the most diverse client base in our history across 40 industries. Our results demonstrate the superiority of Progyny’s offering and the high demand for our solutions.” -- CEO Pete Anevski

On Winning & Competition:

“Unlike many digital point solutions that have sprung up across healthcare recently, including in fertility, Progyny continues to successfully differentiate based on outcome & value.” -- CEO Pete Anevski

“As we look across the marketplace today, we believe we're in the best competitive position that we've ever been in and that we're only widening the distance as the leader in the market… Our clients today include many of the most data-driven and sophisticated buyers of health care services in the world. They understand how to evaluate and choose the solutions that will best meet their needs.” – CEO Pete Anevski

Reiterated all relationships with carriers remain strong.

Reiterated 30% average cost savings per client by using Progyny vs. alternatives. It will hold client costs flat in 2023 vs. overall expected healthcare service inflation of 5%-8% to enhance this edge even more. Not just better outcomes… cost savings too.

25% of Progyny clients raised their benefit for 2023 vs. 2022.

Most of the growth for 2023 came from deals signed in mid to late 2022 despite peaking macro headwinds at that time. Fertility is insulated from macro cyclicality as biological clocks are finite and parental passion strong.

Demand for fertility benefits among millennials is “stronger than ever.”

2023 selling season (to impact 2024 financials):

Early activity from new prospects and previous “not nows” continues to be “extremely positive.”

The pipeline for 2023 has “meaningfully increased” vs 2022. Companies that do not offer fertility benefits appear to be experiencing competitive pressures to do so in order to attract and retain talent.

Picked up a few early wins from an aviation manufacturing company, a union group and the Children’s Hospital Association. This represents 220 hospital systems in the USA. The deal doesn’t force these hospitals to use Progyny, but does recommend they do so.

It announced signing its first professional sports team -- The Detroit Pistons -- after the call. (Love my Pistons… unfortunately)

“Although the last 2 years were good, that doesn't mean we think that's not achievable in the future. In fact, it's the opposite. We think the addressable market and the unmet need is still so big that we expect to continue to have these levels of success for the foreseeable future… The macro trends that have been fueling our growth are intact… No difference in feel from this year’s selling season vs. last year’s.” -- CEO Pete Anevski

ProgynyRx:

97% of new clients for 2023 implemented the ProgynyRx add-on. Rx penetration overall will be 90% in 2023 vs. 85% in 2022 and 73% in 2021.

New Products:

Progyny’s preconception service is now being rolled out.

Its male infertility service will be rolled out this quarter.

Maternity and other women’s health products to be launched throughout 2023.

On Subtly Refuting More Short Seller Claims:

“As expected, accrued and un-billed receivables on a day sales outstanding (DSO) basis, improved by more than 12 days from Q3 to Q4 and ended the year in line with where we concluded 2021.” -- CFO Sean Livingston

e) My Take

I have to admit that this was a wildly satisfying Progyny quarter for me. The company had dealt with two separate short reports during the period. I viciously defended Progyny after both. I was right -- the reports were absolutely bogus. Progyny boasts brisk operating leverage, rapid compounding at scale, a still untapped greenfield opportunity and a tangible outcome & cost-based edge vs. all of the competition. Great company. Great quarter. Maybe someone can publish another shell of a short report so I can buy more shares.

3. SoFi Technologies (SoFi) -- Investor Conference & More

a) Investor Conference

SoFi CFO Chris LaPointe interviewed with KBW securities this past week. Here are the condensed highlights

On Guidance, Macro & Turning GAAP Net Income Positive Q4 2023:

SoFi’s 2023 guide assumes the Fed Funds rate reaches 5% and is cut twice in 2023. As a bank that can use deposits to generate yield and fund loan originations, less cuts in the back half of 2023 would be a profit tailwind for this business. While higher rates will dampen demand for its mortgages and some financial services, higher rates are an accelerant to SoFi’s personal loan product. Why? The rise motivates variable to fixed refinancing which is a main use case here. Personal loans will be a much more important piece of SoFi’s 2023 results than mortgages and financial services. It’s a net positive, and one that could be realized considering expectations of rate cuts continue to be pushed to early 2024.

“We have plenty of room to grow the personal loan business in this rate environment, but we’ll be extremely thoughtful and prudent with how we grow. We will maintain our maniacal focus on credit quality and underwriting the highest quality borrowers.” -- CFO Chris LaPointe

SoFi’s guide also assumes:

2.5% annual GDP contraction

5% unemployment.

Unfavorable credit spreads in asset back securitization (ABS) markets where it still sells some loan pools. Encouragingly, it accessed ABS markets last month at spreads 90 basis point (bps) tighter (more favorable) than its previous deal.

If these pessimistic expectations are too negative, SoFi’s results will benefit. All of this is to say 2023 guidance does not rely on any exogenous tailwinds to be realized. If those exogenous tailwinds come, there will be upside. Ideal setup.

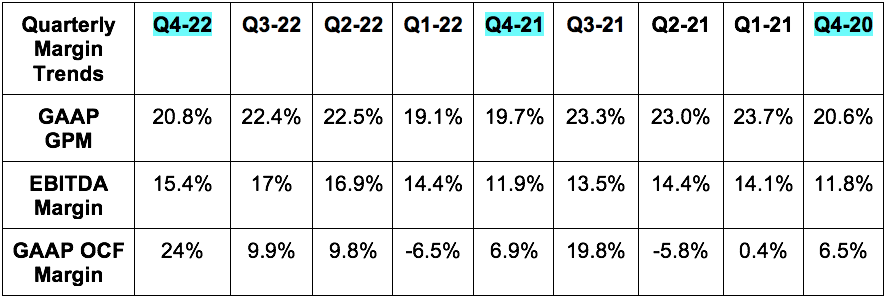

It’s already trending in the right margin direction with EBITDA more than 4Xing YoY and its quarterly EBITDA matching stock comp for the first time in its public history. This is a clear sign that operating profit is now eclipsing the GAAP net income drag that stock comp represents. EBITDA will continue to explosively grow as the business scales and intangible asset amortization related to Technisys M&A fades. This will happen while stock comp does not explosively grow as things like Preferred Stock Units (PSUs) from going public fade away.

On Galileo & the Tech Platform:

Galileo’s cloud migration is now 99% complete. This means it will be freed from operating parallel tech stacks in the cloud and on premise which will be a material boost to margins.

Galileo nearly tripled headcount since SoFi bought it to build out products and integrations. Now, SoFi thinks it’s “ready to realize some synergies and cost savings” from these investments and expects tech platform contribution margin contraction to reverse.

The shifting focus to larger tech customers means longer sales cycles and longer on-boarding times. Once these deals are signed however, the revenue ramp will be far more meaningful than with other Galileo clients. And leadership continues to expect these deals to be a when not if. This is supposed to re-accelerate revenue growth as we move into 2024.

On Direct Deposits:

“We’ve seen no slowdown in overall inflows unlike a lot of other peers out there.” -- CFO Chris LaPointe

LaPointe reiterated that SoFi is enjoying 190 bps of savings with the charter by being able to fund loans with deposits vs. warehouse facilities. It has a lot of room to continue raising its savings annual percent yield (APY) to fortify that top of funnel for member growth. 190 bps of savings on SoFi’s $7.3 billion in deposits means $130 million in annual savings vs. using warehouse facilities to fund its loan book.

On Credit Quality:

SoFi’s overall loan portfolio continues to showcase a life of loan loss rate of 4.45%. Its risk tolerance is 6%-8%, so its loss rates continue to outperform and free cash flow from loans continues to outperform as well. Again, the target markets for SOFI are much higher income than other fintech’s such as Upstart.

b) More SoFi News

Goldman Sachs CEO David Solomon told the press this week that he’s “considering strategic alternatives” for their struggling consumer banking division -- including Marcus. This led many to believe that Goldman will attempt to liquidate its deposit assets and move on from this large earnings drag. Not only does this mean less competition for SoFi, but there’s some fun speculating (key word speculating) we can do here. SoFi’s Anthony Noto previously served as the Co-Head of Technology, Media and Telecommunications (TMT) research at Goldman Sachs. Galileo and SoFi are actively trying to land large banking partners as an investment proof of concept. Leadership is confident these wins will come. Does this mark Goldman thinking about consumer banking in a more partner-first, asset-light manner? Does that mean they’ll partner with or buy SoFi or use Galileo + Technisys to take another stab at consumer banking? Maybe. Maybe not. We’ll see.

SoFI ranked 3rd in Fast Company’s list of most innovative personal finance firms.

Get the power of Wall Street for FREE

TIKR is the ultimate platform for individual investors who want to make better investing decisions. With powerful financial data and tools for over 100,000 stocks globally, TIKR empowers individuals to find and research compelling stocks with confidence.

Follow Top Investors: get an inside look at the portfolios of 10,000+ investors to help you find winning stock ideas.

Find the Best Stocks: screen through 100,000+ stocks with thousands of filters to find the hidden gems with the highest returns potential.

Quickly Analyze Businesses: easily analyze and chart detailed financial data, ratios, valuations, and Wall Street analyst forecasts.

Monitor Your Portfolio: track upcoming events, news, earnings & conference transcripts, and company filings through a powerful watchlist newsfeed.

Sign Up for Free Today (No Credit Card Required)

4. PayPal Holdings (PYPL) – Investor Conferences

On Digital App Stats:

Leadership reiterated the same 30% lift to revenue per account and 50% lower churn for digital app users vs. non-users. They added some more interesting stats including:

Digital wallet users are 2X more likely to choose branded PayPal for checkout.

Digital wallet users transact 60% more frequently than non-users.

High yield savings account users within the digital app contribute another 20% lift to revenue per account.

55% of PayPal users have adopted the app as of now with a company goal to get to 70% by the end of 2023. It will do things like add better package tracking among other new tools to motivate more downloads.

On Bringing Back Low Engagement Users:

PayPal very publicly shifted its user growth philosophy last year from quantity to quality. It wanted to pivot focus to engagement and revenue per account rather than net new active accounts. It saw its promotions to retain low engagement users as carrying a negative return on investment -- so it halted these promotions.

PayPal Consumer Head Doug Bland made it seem like the company may be open to re-embracing low engagement users vs. letting all of them leave the platform. According to him “PayPal is conducting a transaction and cash back test for low engagement users” and has seen a strong lift to re-engagement rates with a positive return on investment. It would be wonderful news if PayPal found a way to profitably leverage customers outside of its highly engaged cohort.

Venmo Notes:

A new pay format upgrade is expected to boost Venmo peer-to-peer (P2P) volume by a few billion in 2023.

It’s testing direct messaging within P2P. This should raise buyer confidence by being able to message a counter-party to confirm they’re the right place to send or request funds. This already raised payment completion in Europe where it’s testing with PayPal P2P.

Teen Venmo accounts are coming “very, very soon.” This adds 25 million Americans to PayPal’s target market with 36% of those users having parents who already use Venmo.

Both Bland and CFO Gabrielle Rabinovitch told us they’re “pleased with Amazon progress” with both teams meeting weekly. It’s still too early to put specific stats behind this new partnership.

On Buy Now, Pay Later (BNPL) & Apple:

PayPal’s deepened Apple partnership will allow it to extend its BNPL products to in-store formats. Because PayPal & Venmo cards can now be added to an Apple wallet, the two companies are working on digital, single use tokens through Apple Pay and PayPal/Venmo for single-use BNPL products. This actually sounds very similar to how SoFi offers the product through Mastercard.

On Q1 so Far & 2023 Guidance:

Q1 continues to be off to a “very good start” with the branded and non-branded strength cited on the Q4 call continuing into March. CFO Gabrielle Rabinovitch added she was “encouraged by the more benign environment.” This, paired with PayPal’s conservative guidance approach , leaves it with “clear upside potential” if it grows faster than its mid-single digit revenue growth guide. This guide bakes in a worst-case macro scenario.

More on Branded Checkout:

While there were some pockets of softness for branded checkout in Q4, as data comes in that softness has become less pronounced. Rabinovitch told us that “as we get more retailer reports, there are indications that branded business really held up well.”

Its new mobile software development kit (SDK) which is fully native to merchant sites is rolling out. This has been shown to raise conversion and PayPal branded checkout share along with PayPal’s latest batch of checkout integrations doing so as well. For merchants with these tools on-boarded, PayPal branded checkout share is stable or rising.

Braintree & the PayPal Commerce Platform (PPCP):

While unbranded Braintree processing and its explosive growth has been a material margin headwind for PayPal, that is set to ease in 2023 for the following reasons:

Braintree had its best year ever in 2022 with landing giant brands. This will lead to slower Braintree growth in 2023.

International expansion carries a larger take rate than giant domestic merchants. Traction here is strong as it just won Shopify’s France business. Shopify is a close partner of Stripe’s which is a direct Braintree competitor.

It will introduce more value-added services which will be margin accretive.

Unbranded is expanding into smaller merchant segments using Braintree’s technology and through the PayPal Commerce Platform (PPCP). PPCP is equipped with the same tools and checkout flow that Braintree merchants love. Smaller merchants mean lower volumes per merchant and higher PayPal take rates.

Braintree will continue to take more market share as its unbranded “loss rates are best in class.” Other value-add services like payouts (thanks to Hyperwallet M&A) are also helping it stand out and land merchants like Uber and Airbnb. These merchants need a diverse range of payout options for their global drivers and hosts. Hyperwallet + Braintree delivers.

Braintree traction routinely means PayPal & Venmo Branded Checkout get better placement and share on merchant sites. This coincides with higher margins & take rates.

The team added that the take rate per Braintree merchant has been very stable.

Final Notes:

Higher rates will bolster PayPal’s interest income that it collects on customer deposits. This will lead to other revenue growth in the high teens for 2023.

PayPal expects to sell its BNPL portfolio by the end of the year to free up a significant chunk of liquidity. I love this. Because most of this portfolio doesn’t generate any interest income, this will NOT be a material revenue and profit growth headwind like when it sold its U.S. consumer credit portfolio to Synchrony.

Flat YoY free cash flow expected for 2023 is solely due to a higher effective tax rate.

5. CrowdStrike (CRWD) – Gartner & the 2023 Threat Report

a) Gartner

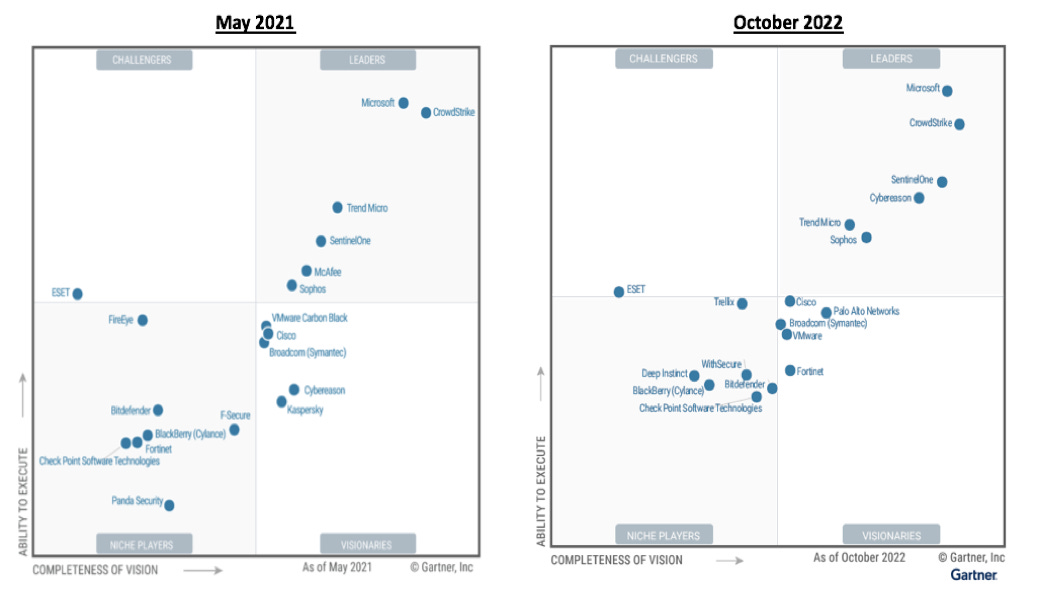

Since CrowdStrike went public in 2019, year after year it has enjoyed elite marks from Gartner -- a prominent 3rd party research organization. Specifically, it again ranked first in completeness of vision and 2nd behind only Microsoft in ability to execute. Of note, SentinelOne continues to see briskly improving scores. Here’s how the 2022 report compares to May 2021:

Per Gartner, CrowdStrike’s Strengths include:

“Innovation & market understanding as evidenced by the breadth of its offering.”

Customer experience and viability. “It continued to perform well in 2022 despite strong competition from newer entrants in the Leader’s Quadrant.”

Managed Detection and Response (MDR).

Humio acquisition “provides a strong base for extended detection and response (XDR) expansion.”

Per Gartner, CrowdStrike’s Weaknesses Include:

Pricing vs. others with less discounting (there’s a reason for that).

No on-premise management option (there’s a reason for that too).

XDR approach is more “immature” than other Leaders. I’d love to see the company address this like it plans to going forward.

b) 2023 CrowdStrike Global Threat Report Highlights

Identity based attacks rose 112% YoY as CrowdStrike’s Zero Trust modules through its Preempt acquisition remain highly needed.

71% of all 2022 breach detections were Malware free vs. 62% YoY & 39% in 2018. Competition to CrowdStrike including SentinelOne prioritizes stopping malware while CrowdStrike fixates on the broader goal of stopping breaches. This stat is why its competition has had to make the philosophical shift that CrowdStrike is years ahead on.

Interactive Intrusion activity rose 50% YoY as hands on hacking continues to proliferate.

Cloud Workload exploitation activity rose 95% YoY.

All of this is to reiterate what we already knew: Cybersecurity will continue to be in great demand and will also continue to be the least discretionary information technology (IT) enterprise spend bucket. It’s not immune to macro pain, but the sector is as resistant to that pain as pretty much any other. This is a great space to play in and CrowdStrike has been able to rapidly gain traction. Specifically, its endpoint market share has more than doubled since its IPO to overtake Microsoft as the largest player in the space. Macro and micro tailwinds continue to blow.

6. Meta Platforms (META) -- Miscellaneous

Brazil’s Central Bank approved WhatsApp Payments. This allows Brazilians -- who religiously use and live on the service -- to pay for transactions from within the app.

The Verge Leaked a leadership presentation on VR plans through 2027. Here are the highlights:

Meta will launch its smart glasses hardware in 2025. This will come with a neural interface that will eventually allow our own hand motions to control the device.

It will launch its first full AR smart glasses hardware in 2027.

Meta’s Quest 3 Headset coming late 2023 will be “2x thinner and 2x more powerful” than Quest 2.

It has sold 20 million Quest headsets so far.

In other VR news, Meta is lowering the price on its Quest 2 headset from $499 to $429 and the Meta Quest Pro from $1,500 to $1,000. Prices were supposedly inhibiting adoption of this technology as sales haven’t been as strong as leadership wanted. To be honest, this is not super concerning to me. Oculus and Meta are still many iterations away from creating a VR headset that will appeal to the consumer and business masses. Until then, it’s a race to getting there and a race that I think Meta is absolutely winning.

7. Upstart (UPST) -- Partners & Comp

a) Partners

Acura (owned by Honda) joined the growing list of auto manufacturers naming Upstart Auto Retail a preferred partner. The list includes Lexus, Mitsubishi, Subaru, Toyota and Volkswagen. Upstart Auto Retail offers a fully omni-channel buying experience, easier closing processes and (supposedly) sharper underwriting. Landing more big names is evidence that these advantages truly exist.

Bank of Denver partnered with Upstart on both personal and auto refinancing. It will join Upstart’s referral network, but is a tiny bank with just over $250 million in total assets. This will not be needle-moving -- securing long term guaranteed funding would be.

b) Paul Gu

Upstart’s CTO got a refresh to his compensation package. A large chunk of his equity-based compensation now features strikes that make the payment worthless. So those shares have been canceled and Gu will now earn more cash compensation. Specifically, he will make $425,000 per year (quite modest) with an ability to earn cash bonuses worth another $318,000.

8. Cresco Labs (CRLBF) -- M&A

Cresco Labs and Columbia Care extended the deadline of their proposed combination from March 31 to June 30 to have time to “finalize divestiture agreements and obtain regulatory approvals.” I want this deal to get done.

Cannabis continues to be a frustrating space to invest. The industry is poised for explosive annual growth for the foreseeable future as states legalize. Cresco specifically boasts among the most productive retail businesses and the largest branded wholesale business in the country. But like everyone else, its operations have been crippled by regulation.

280E means it routinely pays more in taxes than it earns in total operating income. No banking reform means it has no access to basic financial services or insurance. No up-listing reform prevents institutional investors from entering the space and makes for sky high cost of capital. Until these things change, the space will likely remain challenged. But once these things finally change -- and they eventually will -- these companies will “magically” morph into cash printing, respectfully compounding enterprises with investor demand finally able to flood in. Yes, all of this reform will mean interstate commerce and likely pressure on gross margins -- but the overall impact will be convincingly positive. 280E reform alone would vastly prop up profit margins overnight. I’ll continue to be patient and continue to hold my small stake.

9. Snowflake (SNOW) -- Fiscal Year Q4 2023 Earnings Snapshot

a) Results vs. Expectations

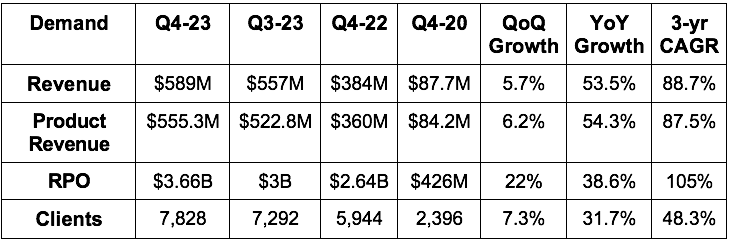

Beat revenue estimates by 2.3% & beat product revenue guide by 3.3%.

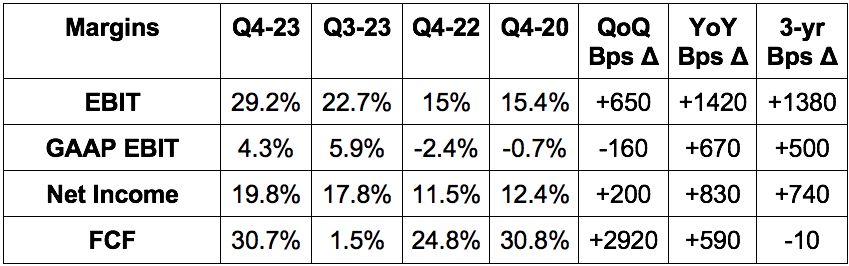

Beat EBIT margin guide of 1% by 460 bps; crushed EBIT estimates.

Beat $0.05 EPS estimates by $0.10.

Beat FCF estimate by 62%.

b) Forward Guidance

Snowflake guided to fiscal year 2024 YoY product revenue growth of 40%. In the previous quarter, it had told investors to expect 47% growth -- meaning this represents a 700 bps guide down. That can’t happen when your company trades for 240x EBIT.

Because it only guides to product revenue, it’s unclear how its EBIT margin guidance precisely compares to estimates. Assuming other revenue is a typical proportion of total revenue, EBIT was roughly in-line to perhaps less than 1% light. Its adjusted FCF guide is also not comparable to consensus FCF estimates.

It will also hire 1,000 people this year vs. 1,900 last year.

c) Balance Sheet

Stock comp was 42.5% of sales vs. 41% last quarter and 38% YoY. I have to be blunt here: That’s egregious. It’s concerning that it hasn’t started to precipitously fall like it has for most other growth companies that IPOed around the same time as it did. In a move to address this, the company announced a brand new $2 billion buyback program to offset all of the equity dilution. There are two ways of looking at this:

Glass half full (which is where I stand) -- Its $4 billion cash pile, $0 in debt and strong cash flows make this an easy maneuver to counteract return-diminishing dilution. This strong liquidity will allow it to buy back the shares without sacrificing needed investments in growth. It must take care of shareholders by addressing this lofty stock compensation.

Glass half empty -- It will buy back shares at one of the most expensive valuation multiples in the entire market. 20x gross profit and 240x EBIT does not seem like that great of a deal for allocating capital for this purpose.

It’s also worth noting that stock comp this past quarter represented 122% of total free cash flow generation. So its strong cash flows that could justify this move are related to the stock comp add back.

d) Call & Release Highlights

Demand Context -- It’s very easy (& intellectually honest) to pick on the capital allocation here, but the growth at large scale is simply elite:

$1 million+ product revenue customers +15% QoQ & 79.3% YoY.

88.7% 3-yr revenue CAGR vs. 96% QoQ & 100% 2 Qs ago.

158% net revenue retention vs. 165% QoQ & 178% YoY. So impressive.

It now has 573 Fortune Global 2000 customers vs. 554 QoQ & 492 YoY.

Snowflake reiterated its goal of $10 billion in calendar 2028 product revenue. This represents a 5 year CAGR of over 30% from the $2.7 billion calendar 2023 base.

Margin Context:

Product gross margin was 75% for the year vs. 74% YoY and 69% 2 years ago. More favorable cloud contract pricing, scale and success with larger customers is driving this leverage.

Adjusted FCF margin of 25% for the year expanded from 12% YoY & -12% 2 years ago. Please note that unexpected cash collections the last month of the quarter aided this margin expansion YoY -- but that was not the main source of the progress.

Macro:

While Snowflake’s quarter was excellent, the guidance was disappointing. During the call, CEO Frank Slootman attributed this to “bookings reticence within some customer segments.” The weakness was most pronounced with international and smaller clients.

Specifically over the last two weeks of its fiscal year (end of January), “pipeline conversion diverged from historical norms” and bookings underwhelmed vs. its expectations. It sees this as “unacceptable”, but CFO Michael Scarpelli added that he was “confident that customers are committed to Snowflake.” The team sees this as a macro-related blip on the radar with long term secular tailwinds fully intact. This sounded nearly identical to many other high growth software firms this quarter.

Final Notes:

Snowflake Proof of Concept (POC) which allows for comparing its efficacy vs. competition is “ramping fast.” The team told us about a Fortune 500 customer who saved $1 million annually by switching to Snowflake from Spark (where Databricks is a key contributor). A financial services firm undergoing the same change enjoyed 8x performance speed and 70% cost savings.

Snowflake expanded its AWS partnership through 2028 which “doubles Snowflake’s previous spend commitment to $2.5 billion” and includes AWS “committing to support joint go-to-market efforts and more favorable pricing.”

10. Salesforce (CRM) -- Fiscal Year Q4 2023 Earnings Snapshot

a) Results vs. Expectations

Beat revenue estimates by 5% & beat guide by 4.9%.

Beat Current RPO (cRPO or service obligations to be completed in the next 12 months) guide by 4.7%.

Beat $1.36 EPS estimates & its same guide by $0.32.

Beat EBIT estimates by 42%.

Beat FCF estimates by 10.7%.

b) Forward Guidance

The full year (fiscal 2024) Salesforce guide was surprisingly strong. Revenue beat expectations by 1.5% while EBIT beat by a whopping 20%. It guided to $7.08 in earnings per share vs. expectations of just $5.87. Nice. Amid a sea of headwinds, this was an impressive standout vs. other large cap software vendors. It guided to stock compensation as a percent of revenue falling to 9% vs. 10.4% YoY as M&A-based stock comp shrinks.

“Our relentless focus on execution & proactive management of the current environment allowed us to close out a strong quarter and set us up for a transformational fiscal year 24.” -- CFO Amy Weaver

c) Balance Sheet

$12.5 billion in cash & equivalents.

$10.5 billion in total debt with $1.2 billion being current.

Buybacks net of stock comp equated to $1.5 billion for the quarter vs. $950 million sequentially.

Raised its buyback authorization from $10 billion to $20 billion to fully offset dilution associated with all of the M&A it has done.

d) Call Highlights

On the Upbeat Guidance & Macro:

Salesforce continues to deal with sales cycle elongation and incremental deal approvals along with shrinking deal size. Its guide assumes these issues last all year, yet it still outperformed expectations handsomely. It talked about the exact same software-based macro issues as everyone else, but its guidance fared better than most.

CEO Marc Benioff credited this strong guide to “customers looking to consolidate platforms and reduce complexity” -- key themes amid software earnings this season. For evidence of this strategy working, Salesforce enjoyed record low customer attrition for the 2nd straight quarter. And again… the strong guide is more evidence.

On Outperforming Margins:

Salesforce – at a recent investor day – told us that its EBIT margin would reach 25%+ by fiscal year 2026 (calendar 2025). Because it’s already over that target 2 years early, it updated this expectation to 30%+ margins by fiscal year 2025. This is being aided by extending the useful life of some equipment like we saw with Microsoft and Meta -- but that was only a small boost to otherwise excellent, ahead of schedule profitability. Of note, it explicitly elected to tell us it’s “not reiterating its fiscal year 2026 $50 billion revenue target due to “uncertain macro and currency environments.”

“I want to emphasize that 30% represents a milestone, but not the destination. We are not putting a ceiling on our margin aspirations.” -- CFO Amy Weaver

M&A:

Salesforce disbanded its M&A committee as leadership feels “confident in the current portfolio.” I thought this was wonderful news as someone who has avoided Salesforce in the past due to the sheer frequency of M&A.

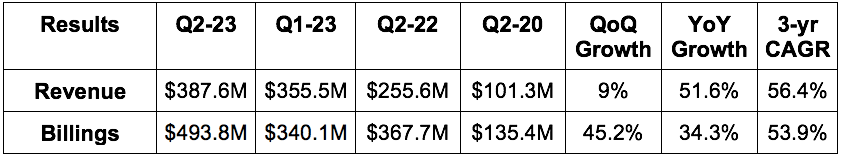

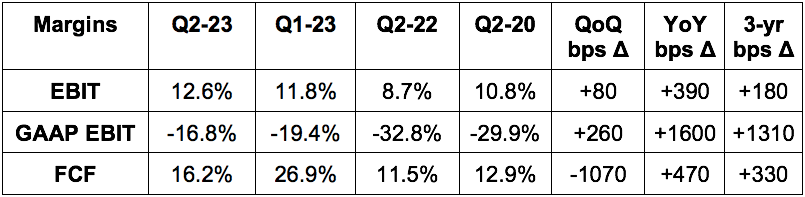

11. Zscaler (ZS) -- Fiscal Year Q2 2023 Earnings

a) Results vs. Expectations

Beat revenue estimate by 6.3% & beat guide by 6.2%.

Beat EBIT estimate by 14.3% & beat guide by 14.8%.

Beat $.29 EPS estimate by $.08 & beat guide by $.07.

Beat FCF guide by 8.8%.

b) Updated Fiscal Year 2023 Guidance

Raised revenue by 2% & beat estimate by 2.2%.

Raised EBIT guide by 17.6% & beat estimate by 17.5%.

Raised $1.24 EPS guide & beat identical estimate by $.28.

c) Balance Sheet

Stock comp was 177% of FCF.

Stock comp was 28.8% of sales vs. 37% QoQ & 39% YoY.

$1.91B in cash & equivalents.

$1.14B in senior convertible notes. Zscaler had to tweak its accounting structure to include interest expense associated with these notes in non-GAAP net income starting last quarter.

No traditional debt.

d) Call & Release Notes

More Results Context:

Customers with $100,000+ in Annual Recurring Revenue (ARR) rose 5.4% QoQ & 33.5% YoY to reach 2,337.

Net revenue retention remained over 125%; gross retention stayed in the “high 90% range.”

Its net promoter score was over +80 which is more than double the average SaaS firm.

Public Sector Progress:

Zscaler Private Access secured FedRAMP Moderate authorization. Zscaler is the first cloud security vendor to have all core services gain this FedRAMP authorization for both High & Moderate Levels. This is a key advantage in landing large federal contracts.

Macro:

Billings growth of 34% YoY greatly lagged 52% YoY revenue growth. This was due to the same reasons that other software vendors have cited. “New customers are being more deliberate on large purchases with incremental approval steps.” Déjà vu. It’s not losing these future deals, they’re just taking long and ramping more slowly. It’s a matter of sales cycle elongation which has become a cliche during the last two earnings seasons for software companies. To help, Zscaler is allowing some larger customers to ramp cloud usage at a slower, elongated rate. This is amplifying the bookings growth decline for now, but will eventually lead to more bookings in year 2 of these contracts. Conversely, existing client revenue expansion remained healthy as evidenced by the 125% net revenue retention figure.

Zscaler’s raised guidance assumes these issues remain through the end of the year. This is why the billings guide was only raised by 0.2% while analysts were expecting the raise to be closer to the 2% revenue guidance boost. If that’s the worst part of a report… I’d say things went pretty well regardless of what the share price did. I wish “you should have raised by a larger percentage” was the weak point of all of my holdings’ reports.

“While not immune to economic slowdown, cybersecurity is more resilient. In my conversations with hundreds of IT executives, cybersecurity remains their #1 priority.” -- Co-Founder/CEO Jay Chaudhry

Layoffs:

To become leaner and to offset the past 2 years of over-hiring, Zscaler is firing 3% of its workforce. It will continue to hire within high priority roles.

Final Software Notes:

I also published snapshots of Workday’s and Veeva System’s earnings reports. The calls were essentially carbon copies of the three above, but the earnings results, guidance and high level context were a bit different and can be seen here. (LINK)

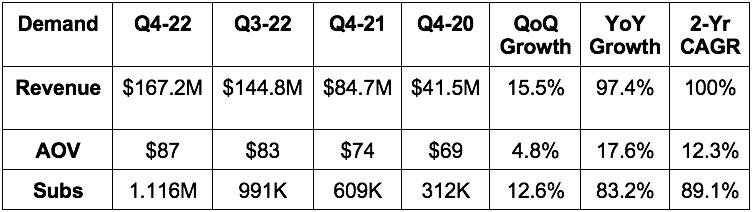

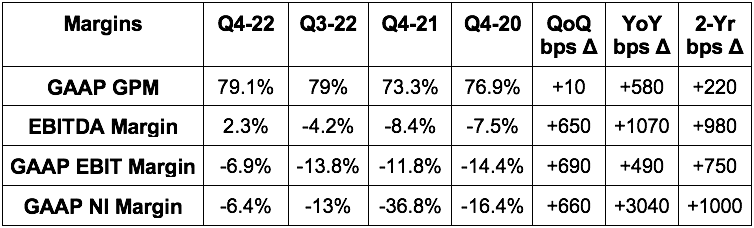

12. Hims & Hers (HIMS) -- Q4 2022 Earnings Snapshot

a) Results vs. Expectations

Beat revenue estimate by 4.3% & beat its guide by 4.2%. This revenue metric represents a 100% 2-year CAGR which accelerated from 87.4% last quarter.

Generated $3.9M in EBITDA vs. estimate of just $1.1M.

Beat -$.06 GAAP EPS estimate by $.01.

Beat GPM estimate by 80 bps.

b) Forward Guidance

Beat revenue estimate by 2.4%.

Beat EBITDA estimate by 36%.

Hims also added a 2025 guidance target of $1.2 billion in revenue and $100 million in EBITDA. This was 26% better than 2025 estimates on revenue and 67% better on EBITDA. Extremely impressive if these numbers come to fruition. And the track record of under promise and over deliver is quickly being established to give investors confidence that they will. 90%+ of its revenue is also recurring, so its book of business is ideally visible for meeting longer term targets.

c) Balance Sheet

Stock comp was 7.3% of sales vs. 7.6% QoQ & 14% YoY.

$178M in cash & equivalents; no debt.

Net income outpacing EBIT is via a Δ in warrant fair value & tax benefits.

d) Call & Release Notes

The call was a victory lap – and deservedly so. Management talked up its rapid growth and how the inflection to positive EBITDA will allow them to lean in even more. They do not see macro in 2023 as a material headwind to achieving its vastly outperforming guide. I will add that the guide does assume successful launches of new personalized products throughout 2023 and a stable 85% retention rate – so this outlook does not seem to be overly pessimistic.

“We are cognizant of a dynamic macroeconomic environment. What we've seen thus far throughout periods of economic uncertainty is that the recurring nature of the platform has afforded us some protection. Additionally, in many of the conditions that we're in, we've seen that they've been largely resistant to macroeconomic headwinds.” -- CFO Yemi Okupe

13. Visa (V) -- Card Data

Visa dropped its 8K this past week with overall consumer spend data for February. As the largest card rail in the world, this offers a great snapshot of the current health and propensity of consumer spending. Here are the highlights:

U.S. credit volume rose 10% YoY in February vs. 14% YoY in January.

U.S. debit volume rose 11% YoY in February vs. 12% YoY in January.

Cross-border volume rose 25% YoY in February vs. 28% YoY in January.

With the most recent CPI reading to 6.4%, this implies 7.6% real YoY credit spend growth and 5.6% real YoY debit spend growth. The consumer is holding up remarkably well regardless of rapidly tightening Fed policy as things like unemployment remain near generational lows. This is good news for companies reliant on a strong consumer demand for Q1 2023 results. Every single consumer discretionary name should be pleased with this data. It could, however, be another data point supporting higher Fed’s higher for longer as it offers direct evidence of the consumer overcoming all of the hikes and quantitative tightening.

To me, the downside here is relatively minor compared to the positivity from the news. What is that downside? Maybe another 25 basis points of hikes and the first rate cut being pushed from the end of 2023 to the start of 2024. In the grand scheme of things, I’ll take consumer strength and a mild recession rather than a more severe one along with this potential negative any day of the week.

14. Macro

a) Key Data from the Week

Output Data:

Core Durable Goods Orders in January rose 0.7% month over month (MoM) vs. 0.1% expected and -0.4% last month.

Durable Goods Orders in January fell 4.5% MoM vs. -4% expected and 5.1% growth last month.

February Manufacturing Purchasing Managers Index (PMI) came in at 47.3 vs. 47.8 expected and 46.9 last month.

February Institute of Supply Management (ISM) PMI was 47.7 vs. 48 expected and 47.4 last month.

February ISM Manufacturing Prices came in at 51.3 vs. 45.1 expected and 44.5 last month.

Non-farm Productivity QoQ for Q4 rose 1.7% vs. 2.6% expected and 1.4% last quarter.

February S&P Global Composite PMI was 50.1 vs. 50.2 expected and 46.8 last month.

February Services PMI was 50.6 vs. 50.5 expected and 46.8 last month.

ISM Non-Manufacturing PMI was 55.1 vs. 54.5 expected and 55.2 last month.

Consumer & Consumption Data

January Pending home sales rose 8.1% vs. 1.0% growth expected.

February Conference Board Consumer Confidence of 102.9 missed expectations of 108.5 and compares to 106 last month.

Initial Jobless Claims of 190,000 vs. 195,000 expected and 192,000 last month.

Inflation Data & Charts:

Unit Labor Costs QoQ for Q4 rose 3.2% vs. 1.6% expected and 2.0% last month.

Truflation’s Real-Time Inflation measure fell below 5% for the first time since inflation exploded higher. It was over 10% as of Summer 2022.

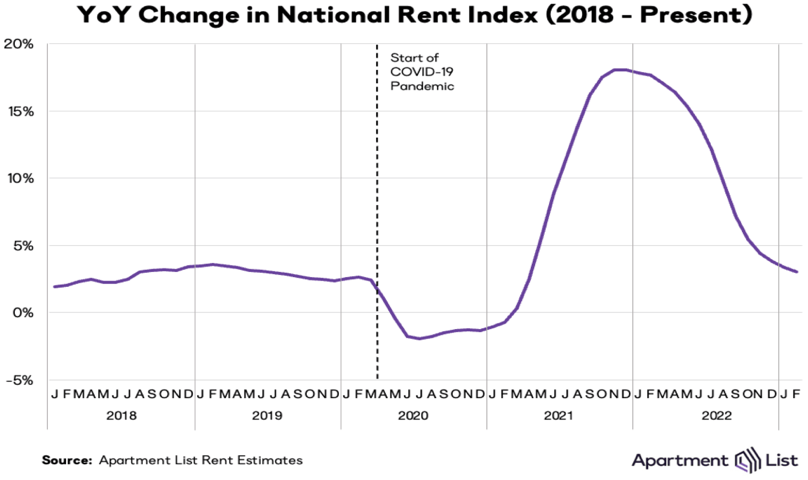

Apartment List’s Rent Inflation Index (another forward looking indicator just like Truflation) Continues to cool beyond normal seasonality:

5-year breakeven inflation is unfortunately heating:

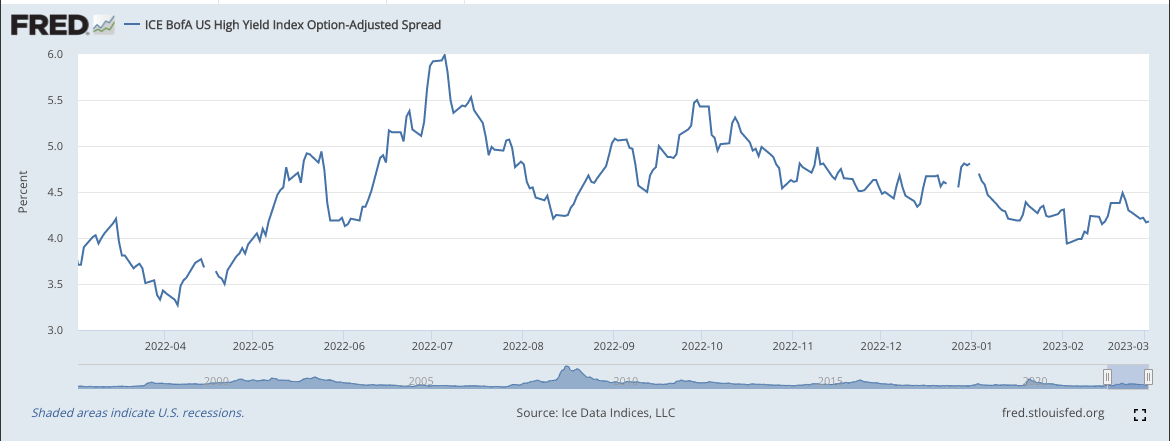

High Yield Option Adjusted Corporate Credit Spreads fell a bit this week (a good thing):

b) Level-Setting the Data

As of January, I saw 25-50 more bps of hikes and a long pause after March as the most likely outcome. I saw cuts coming at the end of 2023.

Cooling inflation paired with a resilient consumer meant the Fed could stop hiking beyond a mild recession and into a deeper depression. This boded well for long duration assets and stabilizing discount rates and credit spreads making growth stocks more compelling assets. While the last few inflationary data points have been hotter, more real-time indicators point to continued cooling.

So? While I now think we could see another hike or 2 and while the first cut could be delayed by a few months… I don’t really care. Multiples have already come in so much. We’ve already gotten several quarters of earnings data amid putrid macro to sift through winners and losers. We’ve already seen an inflation peak. We’ve already heard Chair Powell change the tune of his message. We’ve already had a large chunk of time for markets to digest a peak Fed Funds rate in the 5% range. As long as inflationary readings don’t drastically inflect upward from here, I’m comfortable with my currently small cash position. But that is always a possibility, and the data above like 5 year breakeven inflation rate and wage inflation are certainly not positive data points.

For now, I’ll continue to trim into rapid multiple expansion as long as we still need much more disinflationary progress and as long as we continue to see frequent hiccups interrupting the downward trend. But, I will remain predominantly invested with an ever so slight bias towards accumulation of existing positions (& maybe Google).

15. My Activity

No transactions this week.

Hi, I can't find the Paypal conference on the website. How did you find the info?

Can you analyze Sundays for Dogs?